2024 A Vortex of Tumult & Turmoil

- agoldson888

- Aug 31, 2023

- 11 min read

Updated: Sep 25, 2023

A confluence of global events is raising the geopolitical risk temperatures as rapidly as the meteorological ones without any respite in sight. Each risk component of chaos is not a destabilizing event unto itself, rather it can trigger a domino effect on related and unrelated components.

Aggressively fanning the flames are the ubiquitous mainstream and social media that selectively decide which issues they are providing a hyper-focused echo chamber and which ones are equally high-risk ones that are the proverbial elephant in the room yet blatantly ignored.

GEOPOLITICAL - ELECTIONS

Tension in Taiwan

Kicking off 2024 are the Taiwanese presidential elections scheduled for January 13, 2024. There are 5 candidates either nominated by a party or who are running as an independent which makes it a highly connected election. The inauguration takes place May 20, 2024.

The victorious party leading the future Taiwan government represents a critical hinge in US-China relations on all matters ranging from economic to military.

Taiwan’s paper tiger military is matched by China’s lack of experience and resources to mount any type of effective invasion or blockade of Taiwan. The Chinese leadership has watched in horror as Russia has stumbled badly in Ukraine despite the superior logistical advantage of a shared border.

Furthermore, Taiwan does not have a binding agreement with the US to defend it from military aggression thus the support it would receive from the US and its allies are ambiguous. Counter-intuitively these political and military ambiguities provide a strong deterrent, but not guarantee, against overt Chinese aggression.

China: Drowning in Red

The economic situation in China has probably entered the early stages of deflation as supported by multiple official, unofficial and anecdotal indicators such as plummeting prices, production, high unemployment especially amongst the youth, and falling home prices.

At the forefront is the recent bankruptcy filing by the real estate behemoth Evergrande two years after they defaulted on $360 billion in debt.

The second largest real estate developer, Country Garden, that focuses on projects in 2nd and 3rd tier cities, is $200 billion in debt. The Economist provides a comprehensive overview specifically on Country Garden in an article entitled How Bad Could China’s Property Crisis Get?, dated 19 August 2023.

A worrisome situation is that the Chinese government has suspended the public release of several economic indicators. According to many western economists, Chinese economic figures were often thought of as managed or using inaccurate data resulting in overstated good news or understated bad news. With respect to China, no news is bad news.

On a micro-level, to stem the torrent of investment outflow, the Chinese government has gone so far as to strongly recommend “softer” language with respect to IPO risk descriptions. In the Wall Street Journal article entitled China’s Economy is not Ailing, It’s Evolving dated 11 August 2023, China is strongly requesting changes in the prospectus language such as “adverse changes” to “evolving”, “protracted court proceedings” to “China’s legal system is different from other jurisdictions”, and “change without warning” to “changes from time to time.”

Finally, China faces a nasty demographic crunch with mismatched jobs especially amongst the youth. There are 360 million 16-35 year olds, 25% of the total population, for which many white collar jobs in urban centers have been eliminated. With respect to family life and support, in 2022, 6.8 million couples married which represented half of marriages in 2012.

The worrisome leadership problem is not that China is facing a period of considerably slower growth and increasing debt, rather that the leadership continues to prioritize political loyalty and dogma over economic and demographic reality. Finally, the lack of economic information strongly suggests that deflation has already arrived and that economic hardship is imminent, severe enough to trigger social unrest.

Russia: House of Cards?

Despite the external and internal bloody chaos in Ukraine and liquidation of “disloyal” military generals, former Wagner head Prigozhin and independently minded billionaires, Putin remains standing. Admittedly it is difficult to ascertain whether his reorganization is a house of cards or the strengthening and consolidation of his political foundation. Whatever the actual political condition, Putin’s predetermined victory in the March 17, 2024 is a slam dunk.

The lack of anti-Putin street demonstrations during Prigozhin’s march on Moscow is probably indicative of the fact that the Putin-Prigozhin rift was more of a personal rather than a broad & deep political matter for the citizenry.

Counter-intuitively, with Putin remaining in power makes it far easier for the US and EU to communicate with a long-time known entity vs a chaotic and unpredictable new regime.

Putin is clearly playing a waiting game with respect to the 2024 US presidential elections, a change in American leadership and foreign policy to allow a face-saving end to the war in Ukraine and Russia’s reintegration into the global political and economic community.

Putin’s present-day weakness is his over-dependence on Chinese support that could falter because of China’s deteriorating economic situation and/or political drift in collaboration with the west to end the war.

Chaos Made in America

Despite the official local, state and government crime statistics, the citizenry at all socio-economic levels have witnessed the dramatic spike in violent crime and resultant lowering of quality of life. One major trigger point is the influx of illegal immigrants who are draining local resources. Exacerbating the situation, law enforcement personnel have resigned and/or retired in record numbers.

With respect to leadership, or lack thereof, the president’s physical frailty and cognitive difficulties are apparent at a level that’s far below the minimum requirements to be an effective world leader at the cusp of chaos. For this reason, he’s a de facto lame duck going into the November 2024 elections.

In the meantime, the trials & tribulations of former president Trump are about to light the fuse to near future urban chaos. Every high-level democratically elected leader has bent, even broken the law. This does not exempt former president Trump if the charges against him are proven true.

However, he is being politically “tarred & feathered” and specifically targeted unlike any formerly elected, high-level American politician. Whether one is pro or anti-Trump, one has to realize that he is facing an unprecedented withering and suspiciously enthusiastic one-sided mainstream media attack.

The fury of this one-sided coverage is dramatically raising the risk of social unrest in a country that is already deeply divided. This political instability will spill over into the markets.

Egypt Middle East Bulwark

Egypt is far from a petro-power like their Middle East neighbors but as the most populus Middle East country, they serve as a critical political stabilizer supported by their long relationship with Israel.

Like many leaders in countries that suffer a ravine-wide gap between the wealthy and poor, this gap continues to widen while the elites are hopelessly out of touch with reality. Sadly, this is a stark similarity between autocratic and democratic leaders cocooned and prisoners in their self-created echo chambers. Information fed to them by their appointed minions is nothing more than great tastings with empty calories.

This begs the question whether the February 2024 election is a rallying cry for change, perhaps manifested in the streets, or simply a rubber stamp for business as usual.

Argentina

Although Argentina’s economy is relatively small it has an outsized impact on agricultural exports. Present-day they are suffering through their worst economic crisis since 2001 resulting in 40% of Argentinians living below the poverty line and 110% inflation. Furthermore, they have a $44 billion foreign debt to the IMF.

Farmers require financing including fuel, spare parts and regular maintenance for their farm machinery to harvest which are made exceptionally difficult under these draconian conditions.

The upcoming presidential election this October 2023 will probably pit three candidates including “populist upstart” Libertarian Javier Milei. Although the citizenry strongly desires a different leadership change, the newly elected president will still face not only staunch legislative opposition but also the powerful unions all of whom are opposed to any economic overall.

Even if Milei wins his Liberty Advance party will only have a mere 8 of the 72 seats in the Senate and 35 of 257 seats in the House making any fundamental economic changes extraordinarily difficult to pass.

All three coalition parties are equally supported which probably means that after the election on October 22, there will be a runoff on November 19. According to Argentine election rules, a party can win outright if they secure 40% of the vote and 10% more than the next party, an unlikely event in an ultra-competitive field.

For this reason, Argentina’s economic woes will continue and probably worsen well past the October elections probably imperiling agricultural exports which are needed globally more than ever.

The Collapse of Fragile African Democracies

The following chart entitled A Renewed Wave of Coups in Africa? highlights the spike in coup attempts after a relatively stable political scene between 2013-2020. Since 2020 there have been 13 coup attempts.

Political instability in the Sahel namely Sudan, Chad, Burkina Faso and Mali may have a domino effect on the continent “inspiring” rival forces to agitate more forcefully against young democracies. [Perhaps this domino effect is already underway with the military coup in Gabon yesterday on 30 August 2023].

With respect to potential economic consequences, the following chart entitled Niger is a Major Uranium Supplier to the EU provided by Euratom Supply Agency underscores Niger as a critical supplier to the EU.

Although Niger is the 7th largest exporter of uranium, an interruption of exports of this strategic commodity to the EU will have a noticeable impact. The EU is increasingly dependent on alternate power sources as a result of disengaging from dependency on oil & gas imports from Russia due to the war in Ukraine.

Despite the recent implosion of young and fragile African democracies, the only direct economic risk is if the new authoritarian regimes halt or limit exports of valuable resources to the west through forced renegotiation of current contracts and their terms & conditions.

Politically, it is more symbolic as new regimes pivot more towards Russia and China. It becomes a threat should these countries prioritize exports to the west’s rivals in a zero-sum arrangement.

WORLD ECONOMY – DEEP DEBT

The link to the following chart entitled Global Debt Projection (2005-2027P) provided by Visual Capitalist presents the present-day global debt situation ($305 trillion of debt 1Q2023) up to 2027 discussing its sustainability and possible consequences of high debt, country-specific debt, advanced vs emerging market debt, the countries that will reduce their debt and others (many of which are developed countries) will not.

POISONOUS POTPOURRI

The following perspectives represent three interconnected areas that could boil over: the socio-economic inequity chasm, the erosion of workers’ rights and elimination of jobs through high-tech, and increase in food prices.

Socio-Economic Inequity

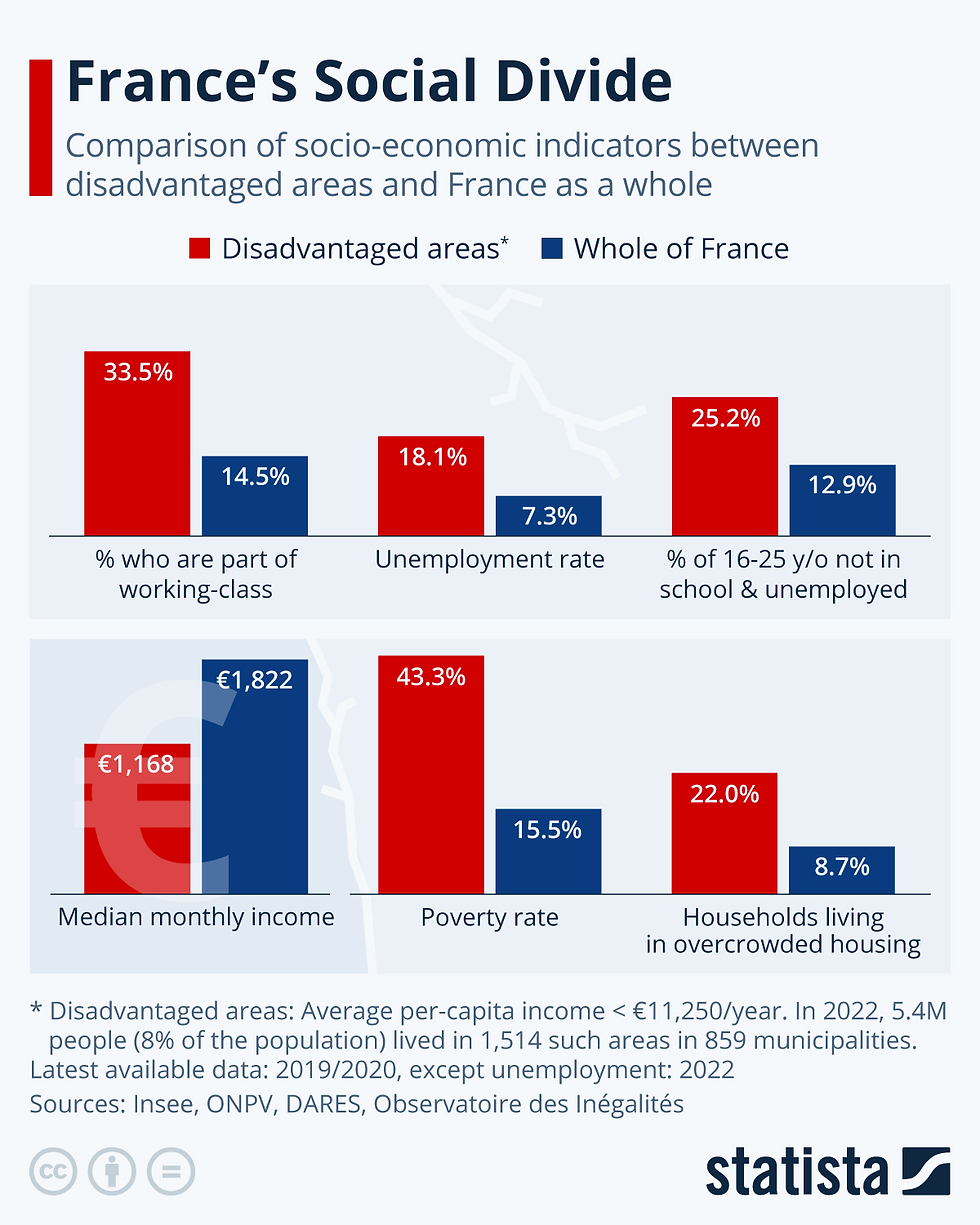

The underlying fundamentals and subsequent fatal encounter between a non-white French citizen and law enforcement earlier this year that triggered urban riots in French cities, is the same recipe for disaster in most American and European cities.

The chart below entitled France’s Social Divide provided by Insee, ONPV, DARES and Observatoire des Inegalities is somewhat similar to many in western democracies and which have been widening exponentially. With far less available and affordable resources such as good education, health services, the disadvantaged will inevitably feel embittered and justifiably lash out at the contempt shown by the government and elite.

Emerging High Tech, Low Workplace Security

The following chart entitled The State of Global Workers’ Rights provided by the International Trade Union Confederation (ITUC), countries ranked, “based on the right to freedom of association, the right to collective bargaining and the right to strike.”

This chart presents a snapshot and insight into the state of dissatisfaction among the “salt of the earth” workers who are increasingly being displaced by technology and whose participation in any protest would be significant enough for governments to engage potentially aggressive security forces.

Food Inflation

Inflation has been the most worrisome factor especially food whose costs across the G7 economies are considerably higher than other categories as captured in the following chart entitled Which G7 Economies Have the Highest Inflation provided by the OECD and Statistics Bureau of Japan. Amongst the categories, food inflation stands far above the others.

If the citizenry has difficulties with ever increasing food prices in a low-growth economic environment, can you imagine the urban instability that could result in a deep recession.

Furthermore, food prices in emerging economies are heavily subsidized by the government. If these governments lack sufficient foreign reserves to purchase and import higher priced agricultural basics or if there is little to buy regardless of robust foreign reserves, then a societal implosion is inevitable.

Agricultural Armageddon | Food Security

High food prices will not abate for the foreseeable future. Another element to the aforementioned instability is the disruptive global weather which has and continues to have a deleterious impact on agricultural crop yields and quality. The highest risk is that the countries with the highest food productions may be barely able to feed its own citizens and unable to export any to other countries who are highly dependent.

Globally supply chain & logistical difficulties continue with drought conditions hampering operations most notably at critical chokepoint transit points such as the Panama Canal and the Rhine. For many months, water levels continue to be too low to carry full loads thus lighter cargo must be transported. Furthermore, there has been a dramatic increase in labor costs and insurance premiums against higher risk situations like war and extreme weather.

The battlefield has widened and deepened in Ukraine. As if on cue, since the end of the Grain Initiative, Russia has aggressively targeted Ukraine’s food supplies and infrastructure crippling exports.

Russia’s recent refusal to renew the Black Sea Grain Initiative adds fuel to the fire. Furthermore, Russian missile attacks on Ukraine’s port infrastructure and grain supplies exacerbate a swift resumption of exports should Russia decide to renew the Grain Initiative.

The following chart entitled The Vital Importance of the Black Sea Grain Initiative provided by the United Nations Office for the Coordination of Humanitarian Affairs provides the top destinations of Ukrainian grain.

The present-day and near future situation is as follows: According to the Ukrainian Grain Association in the Wall Street Journal article entitled Ukraine’s Farmers Count the Cost of Grain Deal’s Collapse dated 26 August 2023.

This upcoming fall season the projected Ukrainian exports is 57 million metric tons. With the blockade of the Black Sea, the alternate route is through two small ports on the Danube and land routes with EU border countries. However, these export routes have a maximum capacity of 15-16 million metric tons annually. With the upcoming busy season in September and October, most of the season’s harvest may rot.

Furthermore, more countries are limiting or even halting all food exports for purposes of domestic food security. This policy immediately placates the public indicating a government putting their citizenry first.

Domestic Food Security Danger

Domestically in the US there are unconfirmed anecdotal reports that there is some creative food processing accounting. According to these anecdotal reports, food processing companies are distributing feed grain quality grains because of the shortfall of higher quality human quality grains due to severe weather conditions.

Furthermore, cold storage facilities inventory is far lower than normal as food companies are distributing these items to maintain healthy inventories and profits in stores. In other words, we could be heading down the proverbial Road to Perdition and suddenly face an acute food shortage.

METEOROLOGICAL MELTDOWN

It’s merely a matter of semantics whether one calls it “climate change” or a natural cycle exacerbated by the El Niño phenomenon, higher than normal surface sea temperatures and soaring global temperatures have severely devastated the agricultural industry resulting in a dramatic drop in harvests.

The following chart entitled World Sees Record Heat Waves provided by the World Meteorological Organization and others, reinforce how the heat is impacting the quantity and quality of crop yields.

Conclusion & Takeaways

The confluence and interconnectedness of the aforementioned slow building trends have created the perfect tinderbox with potential catastrophic cascading effects.

Governments and central banks woefully lack the fiscal tools to stem a steep and prolonged economic slide.

Science is helpless, as always, in the face of Mother Nature’s global wrath on food supplies.

In technology, AI robots are displacing human workers and will continue to do so at a rapid pace enabling corporations to lower expensive labor costs but at the same time increase unemployment among workers with no other transferable skills in a tight labor market.

In sum, wherever you look there’s no room for global growth in the foreseeable future. This time it’s not a question of muddling through rather surviving a brutal period of chaos. Like a rogue wave this crisis will arrive and hit hard and fast.

© Copyright 2023 Cerulean Council LLC

The Cerulean Council is a NYC-based think-tank that provides prescient, beyond-the-horizon, contrarian perspectives and risk assessments on geopolitical dynamics and global urban security.

Comments